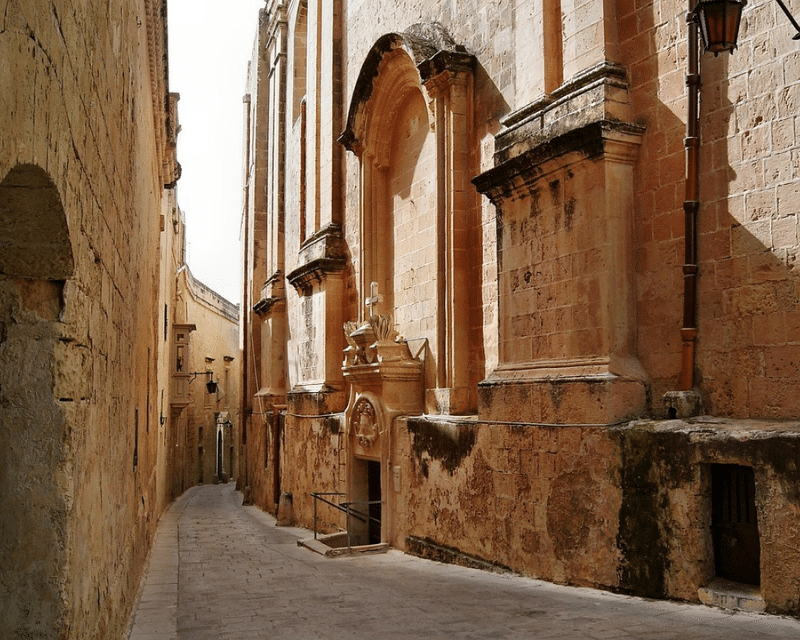

Malta’s corporate tax system offers significant opportunities, but it also requires careful navigation to ensure compliance and efficiency. At A2CO, we provide clear, practical advice tailored to your business needs.

We support clients in establishing and maintaining substance in Malta, structuring corporate tax efficiently, and making full use of the tax refund mechanism and relief from double taxation methods. Our team advises on compliance with EU and OECD measures, including transfer pricing.

Whether you are establishing a new company in Malta or managing an existing structure, we help you make informed decisions with confidence.

Speak to our team to discuss how we can support your corporate tax needs in Malta.